Bitcoin Buddhism 🧘♂️💸

Proof-of-Take (#010): a dose of perspective and context in the world of Bitcoin

Welcome to Proof-of-Take. The separation of Money and State, enabled by Bitcoin, will happen in our lifetime. It will be one of the most important developments in the history of civilization. This is on-par with inventions like the printing press, antibiotics, and the internet. By the end of it, we may even be able to explain what a blockchain is.

As always, nothing below is investment, legal, or relationship advice.

I recently returned from a 10 day Silent Meditation Retreat. For 10 days, you lead the life of a monk, practicing the same meditation technique the Buddha used to achieve enlightenment.

You wake up at 4am, meditate for 10 hours, and go to sleep. You’re given modest meals and accommodations. Speaking, eye contact, reading, and writing are forbidden, and all electronics are confiscated.

It’s quite the experience.

Naturally, during my 10 hours of daily meditation, my mind often wandered to Bitcoin. This retreat was in the Buddhist tradition and I discovered some deep similarities between Bitcoin and Buddhism.

🧘♂️ Buddhism is the Red Pill for Consciousness.

💸 Bitcoin is the Red Pill for Money.

Buddhism’s basic teaching is that we suffer because we are deluded in how we see reality. Instead of seeing it clearly and objectively , we view it through the lens of made-up stories we repeat about ourselves and others. Stories about our past, stories about our future, and stories about our self.

When you identify with and react to these stories, you suffer. When you finally see reality clearly, you wake up. You are liberated from suffering and become enlightened (a “Buddha”).

Money is the most powerful made-up story humanity ever created. And Bitcoin opens our eyes to see money for what it really is—an intersubjective myth. It’s a shared fable about green pieces of paper and entries in a database. It only has power because we collectively believe it does.

All money, not just Bitcoin, is “magic internet money”—90% of dollars are just entries in a database with no bills in existence.

All money, not just Bitcoin is “backed by nothing”—in today’s world of fiat money, nothing supports the US Dollar but a promise (a made-up story) from the government.

Buddhism makes us rethink our core assumptions about the nature of our mind.

Bitcoin makes us rethink our core assumptions about the nature of our money.

And once we see the world as it really is, we can never unsee it.

There’s no going back up the rabbit hole once you’ve fallen down.

The point of these Red Pills is to reduce suffering

Whether it’s Buddhism or Bitcoin, there’s a reason behind taking the Red Pill—to reduce our suffering.

Meditation isn’t just a game you play to experience novel sensations and states of consciousness. The point is realize the harm we cause ourselves through our delusions about consciousnesses. And break free of them.

And Bitcoin isn’t just a game you to play to accumulate magic internet money. The point is to realize the harm we cause ourselves through our delusions about money. And break free of them.

When you truly embrace Buddhism or Bitcoin, you do so to reduce the aggregate suffering in the world.

The truths in these Red Pills can be difficult to swallow. Some may decide that ignorance about the nature of reality is bliss.

Nobody said it would be easy. They just said it would be worth it.

“Don’t trust, verify”

-The Buddha

The technique that Buddha used to become enlightened is very specific—known as Vipassana. Essentially, it teaches you to become aware and equanimous towards the sensations on every single part of your body and mind. You observe everything but react to nothing. Once you gain full mastery over the body and mind, you can transcend the body and mind, to something greater (enlightenment).

Importantly though, the Buddha was against blind devotion and ritualistic worship of this technique. As our teacher during the course said:

This is not a dogma to be accepted on faith, nor a philosophy to be accepted intellectually. You have to investigate yourself to discover the truth. Accept it as true only when you experience it. Hearing about truth is important, but it must lead to actual practice. All the teachings of the Buddha must be practiced and experienced for oneself.

This is in-line with the Bitcoin ethos of “Don’t trust, verify.” The entire point of Bitcoin’s peer-to-peer network is that no participant has to trust anyone who says a transaction is valid, or a money supply is fixed—you can verify it yourself. You should not accept on blind faith that Bitcoin is limited to 21 million coins or that double spending is forbidden simply because Coinbase or Bitmain or Donald Trump says so. Run a full node and see for yourself.

Don’t trust, verify.

You hold the (private) key to your own salvation.

In Buddhism, achieving enlightenment is viewed as the ultimate salvation. But instead of being promised eternity in heaven, you’re simply promised an end to the misery and suffering that is existence.

Importantly, no singular deity or prophet can deliver you to this salvation. Praying to the Buddha, god almighty, or Jesus Christ won’t take you there. Enlightenment is a path, and you must walk the path yourself. Only you can break the cycle of your own suffering. You are sovereign over your fate.

Bitcoin relies on a similar ethos in 2 ways. First, Bitcoin itself is a self-sovereign money. It relies on no singular government or financial institution to tweak or optimize policy. And no singular Bitcoin leader will deliver Bitcoiners to paradise either. Second, Bitcoin allows the users themselves to fully control their wealth via holding their private keys.

You hold the (private) key to your own salvation.

⏳ Lowering your time preference ⌛️

Buddhsim, like Bitcoin, has the effect of lowering your time preference. While meditating, you observe, every craving and aversion that arises within you — without reacting to any of them. From back pain, to hunger, and boredom to anxiety. The easiest way to do this is to realize that each of these is an impermanent feeling that will eventually pass away. No itch lasts forever.

Just like Bitcoin, cultivating this non-reactivity towards cravings and aversions has the impact of lowering your time preference. You are no longer desperate to instantly gratify your urges. That must-have impulse purchase is now powerless over you. There are fewer online shopping sprees, expensive dinners, and large bar tabs. This lets you both (A) be more content in the present, while (B) carrying your purchasing power into the future.

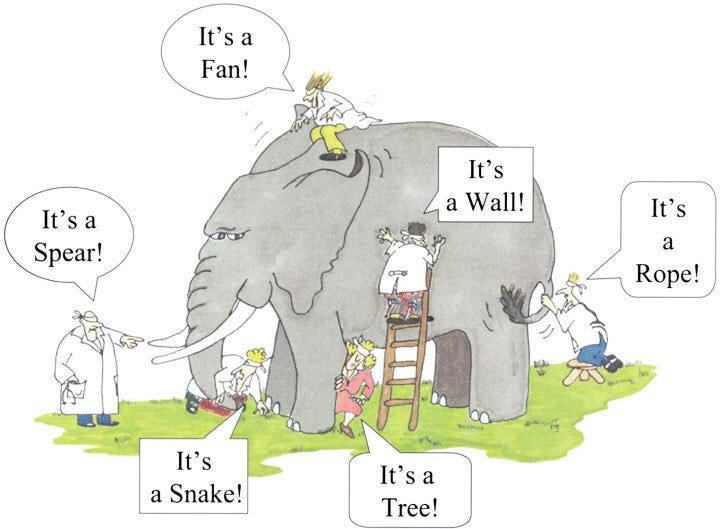

🐘 Different things to different people, and that’s okay 🐘

There’s a popular proverb (meme) called “The Blind Men & The Elephant” that pops up when Crypto Twitter argues over the “true use case” for Bitcoin. On the fifth day of the retreat, I nearly fell off my meditation cushion when our teacher started describing the same meme, but about Buddhism.

As the story goes, a group of blind men are brought to an elephant, but not told it’s an elephant. Each one is brought to a different part and asked to describe the object they’re touching.

The man at the tusk says “It’s a spear!”

The man at the tail says “No, it’s a rope!”

The man at the leg says “No, it’s a tree!”

Our teacher told us this story in the context of this meditation technique. You do not need to take as gospel everything the teacher says. Vipassana lets you pick and choose. Inspect what this technique actually teaches you, and accept that as true — and discard everything else.

This lesson also applies to Bitcoin:

Bitcoiner 1: “It’s a speculative, uncorrelated asset for my portfolio!”

Bitcoiner 2: “No, it’s a tool for cheaper international transactions!”

Bitcoiner 3: “No, it’s a check on government inflation!”

They are not mutually exclusive. It can be each of these things to each of these people. After all, money is just a made-up story anyway.

🌱 You reap what you sow. Be careful the seed you plant 🌱

A main lesson on the retreat was that you reap what you sow. Planting a small, fragile seed may seem like an insignificant act at first, but the seed grows exponentially and eventually becomes massive.

According to this tradition, each time you react with craving or aversion to something, you are planting a small, fragile seed deep in the soil of your subconscious. So long as you remain ignorant towards the nature of the mind, your subconscious will be a fertile swamp, and that seed will grow. And as it grows, your misery will be multiplied. A bitter tree will sprout up. You reap what you sow.

And when you begin to meditate deeply, becoming aware and equanimous, you are also planting a small, fragile seed deep in your subconscious. Your daily meditation practice acts like water and sunlight on this seed. And as it grows, your misery will be reduced. A mighty tree will sprout up. You reap what you sow.

Bitcoin also began as a small, fragile seed. This metaphor is captured beautifully in Dan Held’s Planting Bitcoin series. As Dan says:

Bitcoin’s origin is akin to planting a tree. It wasn’t just Satoshi’s selection of the species (code), but the season (timing), soil (distribution), and gardening (community) that were essential to its success.

Bitcoiners stand ready to reap what Satoshi has sown.

Not all that glitters is (digital) gold?

Naturally, there are elements of Bitcoin and Buddhism that are tough to reconcile. While Bitcoin preaches carnivory, Buddhism is against the deliberate killing of any sentient being. While much of Crypto Twitter is folks attacking one another, Buddhism, teaches non-reaction and equanimity.

Still, when you’ve deeply experienced each of these worlds, it’s difficult to ignore the similarities.

I’ll leave you with a story we were told on the retreat.

Many years ago, a young man started barefoot on an epically long journey. He began walking on a path that stretched thousands and thousands of miles. This whole path was littered with sharp rocks, brambles, and other impediments.

The man, barefoot, starts walking. After a few paces, he steps on a bramble. Ow! He reaches down and pulls the bramble out of his foot. Next, he steps on a sharp rock, and experiences a searing pain. Frustrated, he resolves to clear the path himself. He bends down and sweeps each rock and bramble out of his way. He proceeds agonizingly slow.

Finally, he meets another traveler, an older man. The older man sees the young man hunched over, clearing each rock and bramble out of the way and says:

What are you doing? You’ll walk the whole path paying attention and fighting each obstacle? You’ll never reach the end.

The young man says

I know, but what choice do I have? These rocks and brambles are painful. They are unavoidable They cut me and I bleed, I must clear them out of the way.

Then the old man smiles and points to his own feet.

My friend, you do not need to avoid them, and you do not need to clear them. Just put on a pair of these shoes. Instead of being tortured and governed by these rocks and brambles, you’ll calmly walk over your obstacles.

The lesson? On the path of life, we will be confronted by obstacles, vicissitudes, and changes in fortune. They are unavoidable. They can be painful. But instead of obsessing on they pain they cause or clearing them out of your path, put on a pair of shoes.

In Buddhism as in Bitcoin, putting on your shoes means cultivating awareness, and equanimity. You are not a prisoner of your emotions or your thoughts. You are not a prisoner of Bitcoin’s price or Crypto Twitter. Ignore the noise and see reality for what it truly is.

You hold the (private) key to your own salvation.

Thanks for reading! If you loved (or hated) this post, please forward it and share on social media 🙏. I’d also like to hear what you think about it. Hit me up on twitter @canthardywait.

If you’re interested in learning more about the 10 Day Silent Meditation retreat, I wrote a blog post about it here